Holistic Life Planning

Equitable

Problems

- For customers: advisors aren’t the go-to experts anymore, apps fill the gap but aren’t for everyone + everything, + financial complexity increases while trust in large financial organizations declines.

- For Equitable: like other financial + insurance companies, advisors’ source of revenue decreases due to technological advancements + evolving consumer expectations.

Challenges

- How might Equitable understand what resonates with customers?

- How might Equitable signal commitment to change?

- How might we do so through human-centricity for existing + future customers across their end-to-end financial + insurance needs + ever-changing lives?

.

Solutions

- Create a phased, multi-year strategy to help Equitable become a leader in Holistic Life Planning in the U.S. to help customers live long, fulfilling lives when change is the only constant.

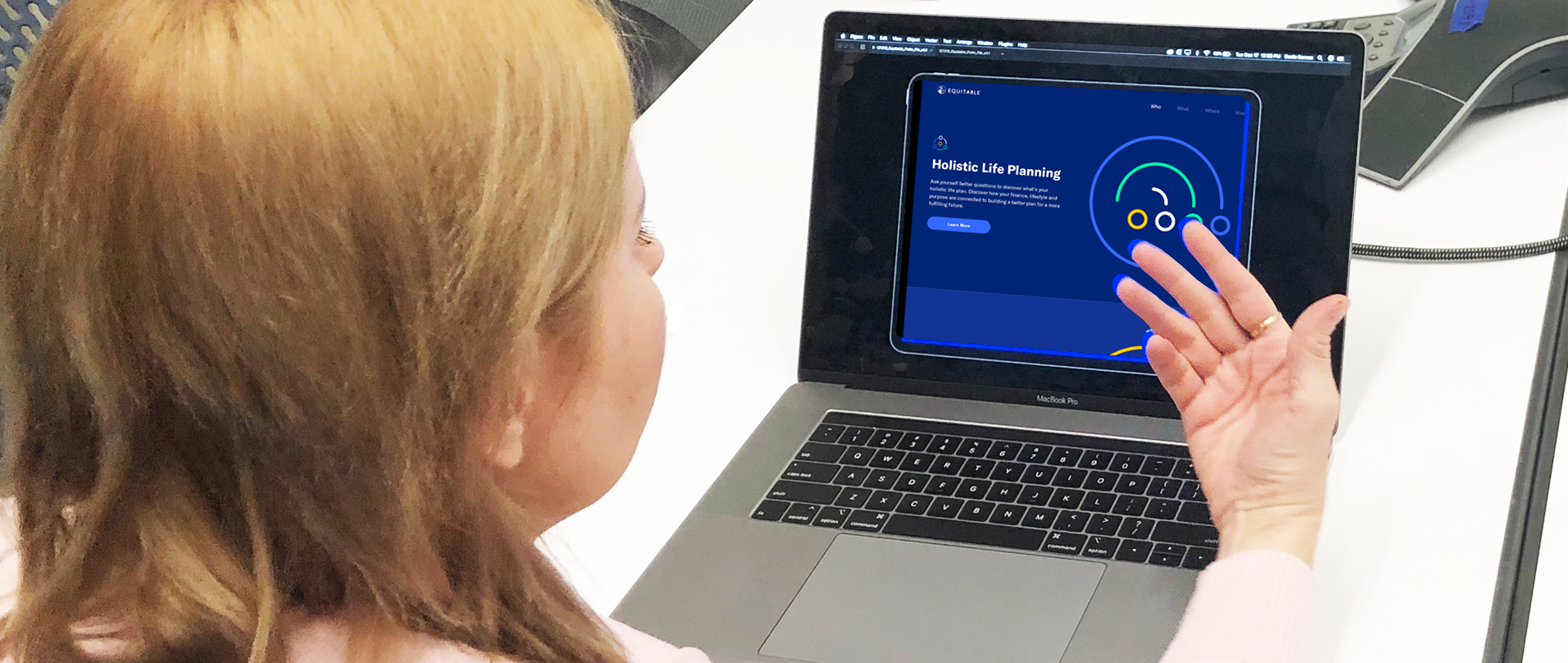

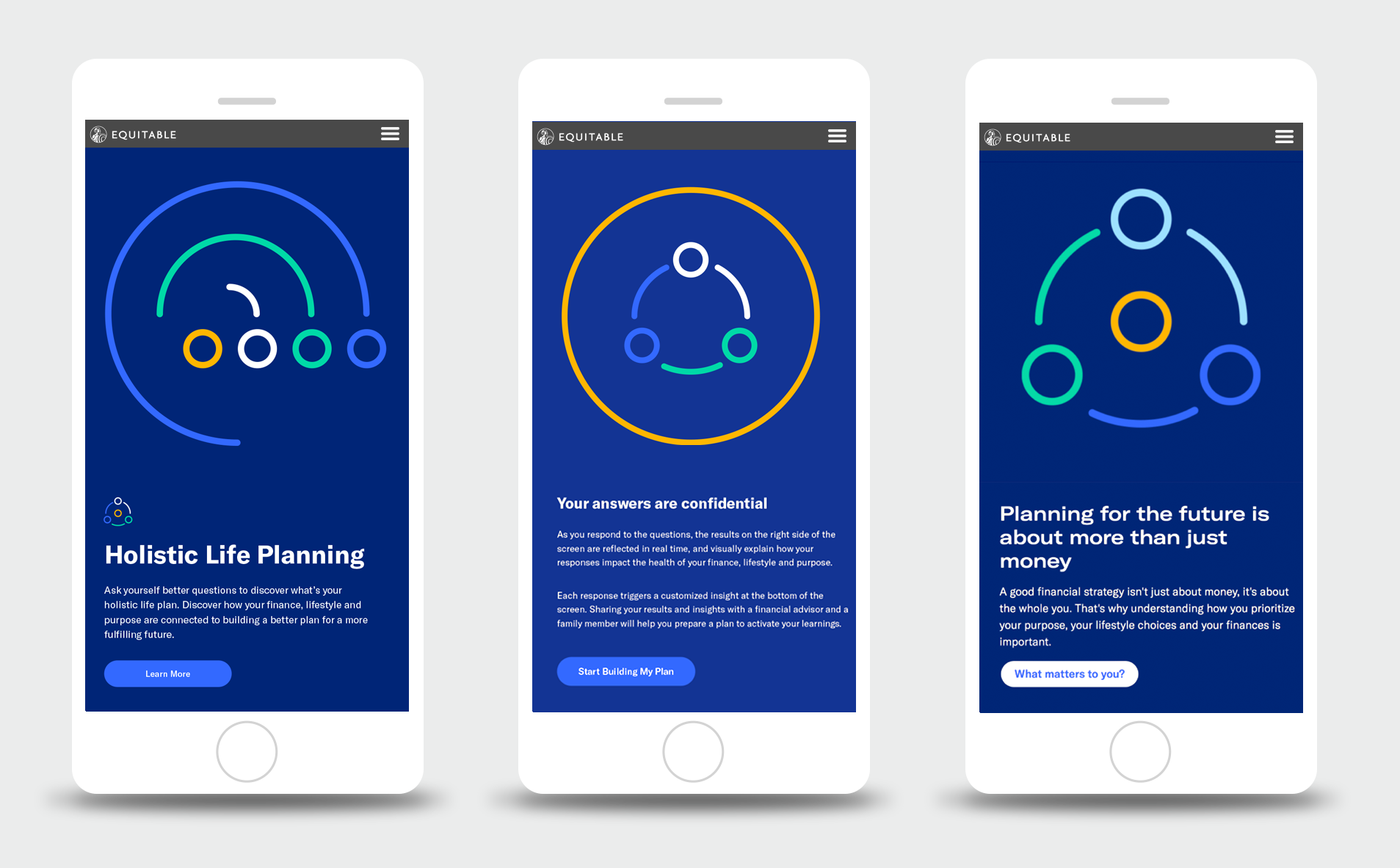

- Create the first digital engagement tool to lead this vision, be the first step of bringing this strategy to life + collect data on what customers need + want, + signal Equitable commitment to Holistic Life Planning.

Results

- Based on quantitative research (interviews + observations), insights were uncovered on existing + future customer needs.

- The digital engagement tool uncovered large-scale, qualitative, nuanced insights.

- This informed who would be the future customer, created financial + insurance tools, + changed management strategy + advisors’ training.

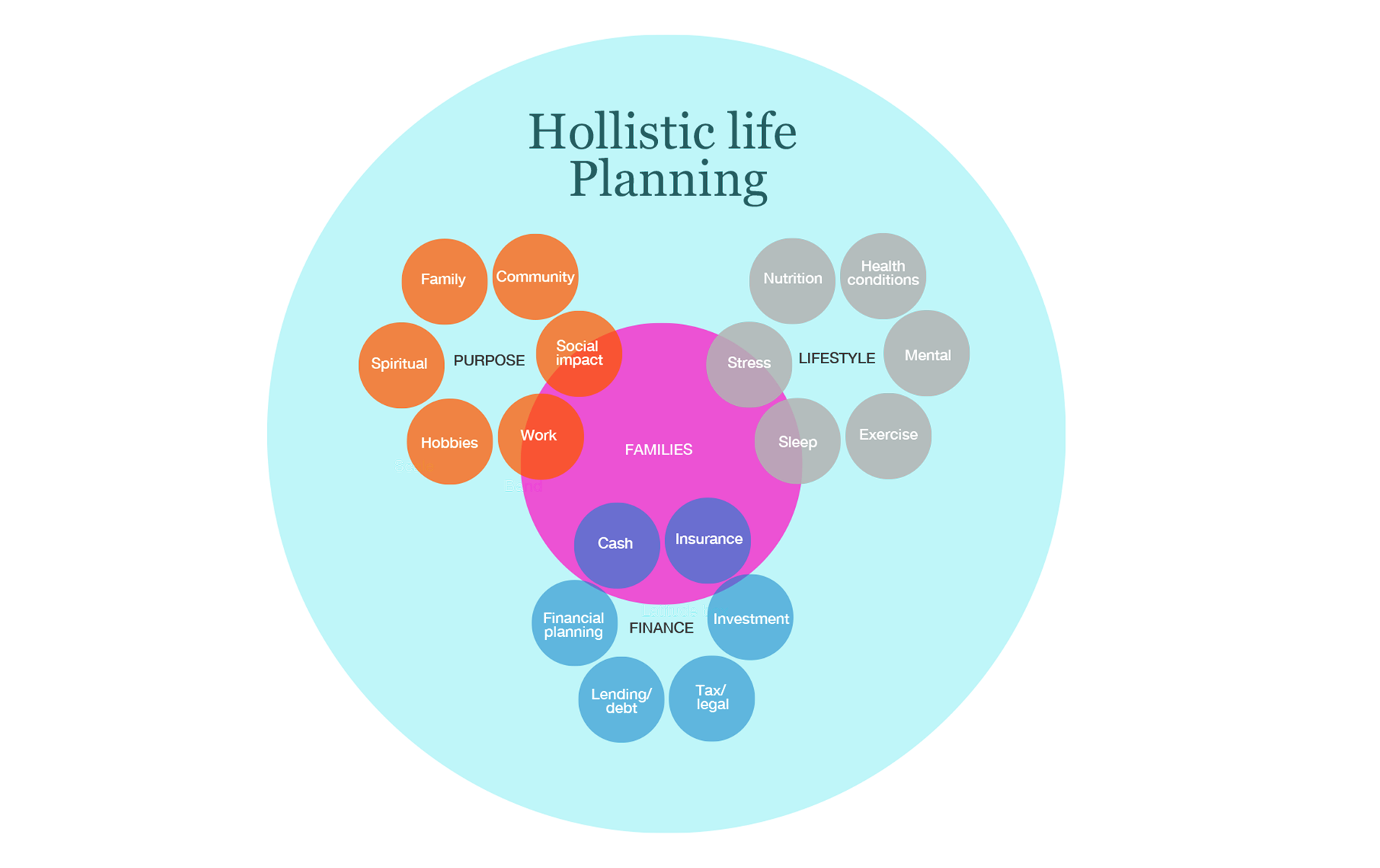

Holistic Life Planning

Based on research + interviews with experts in financial psychology, we created a strategy featuring Holistic Life Planning as an approach that integrates multiple aspects of life including career, health, relationships, finances, spirituality, + personal growth into a unified plan, leading to more sustainable + stress-free financial decisions.

Behavioral Economics + Decision Making

- Based on research in behavioral economics + decision making, people often make irrational financial decisions that might be predicted + influenced.

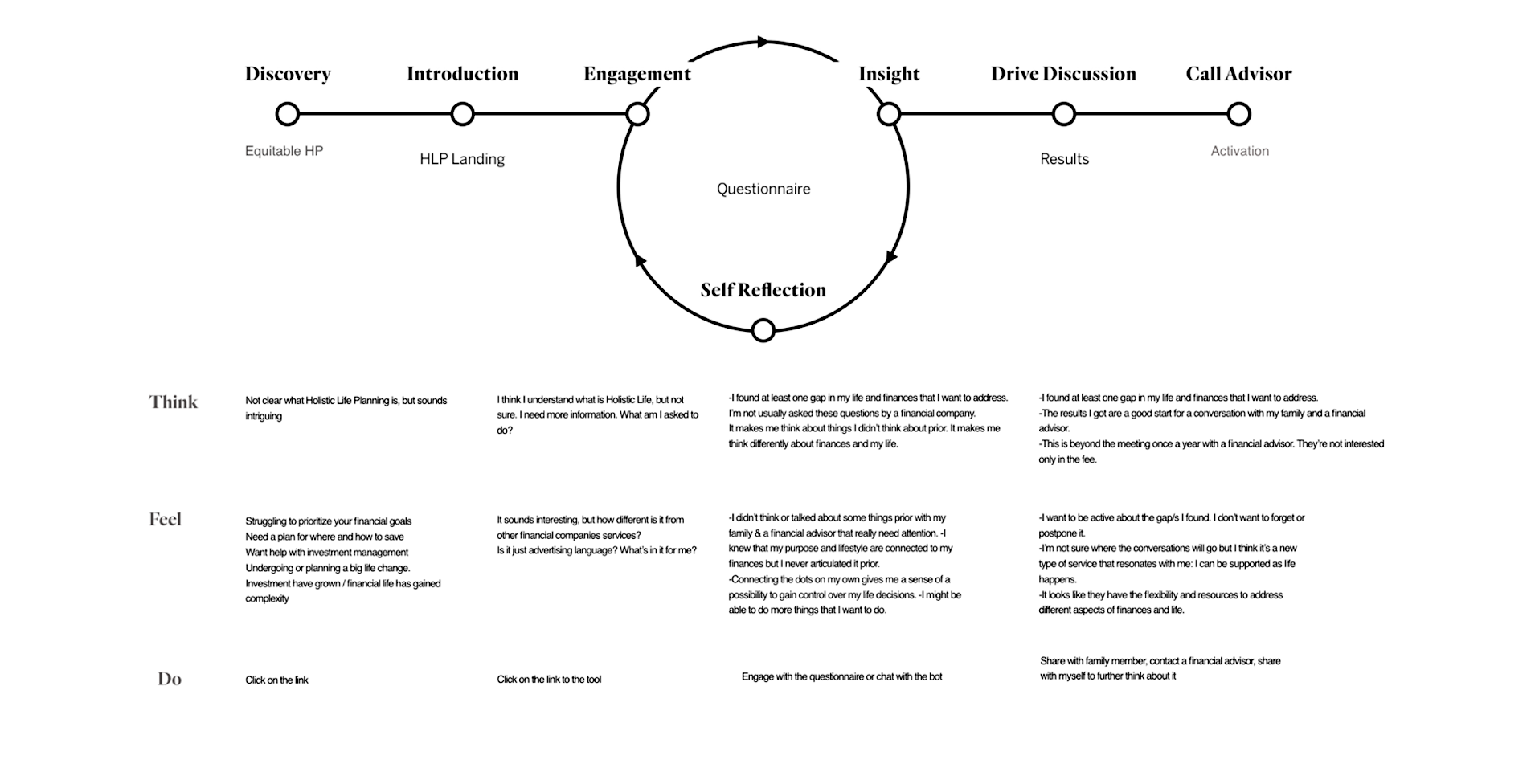

- Based on interviews + iterative user testing we conducted with current + potential future customers across income, net worth brackets, age, gender, + race, we tried to uncover gaps between what they feel, think, say + do across their financial journeys + how, when, + how much we could nudge them to improve life quality through financial decision making.

Iterative Prototyping

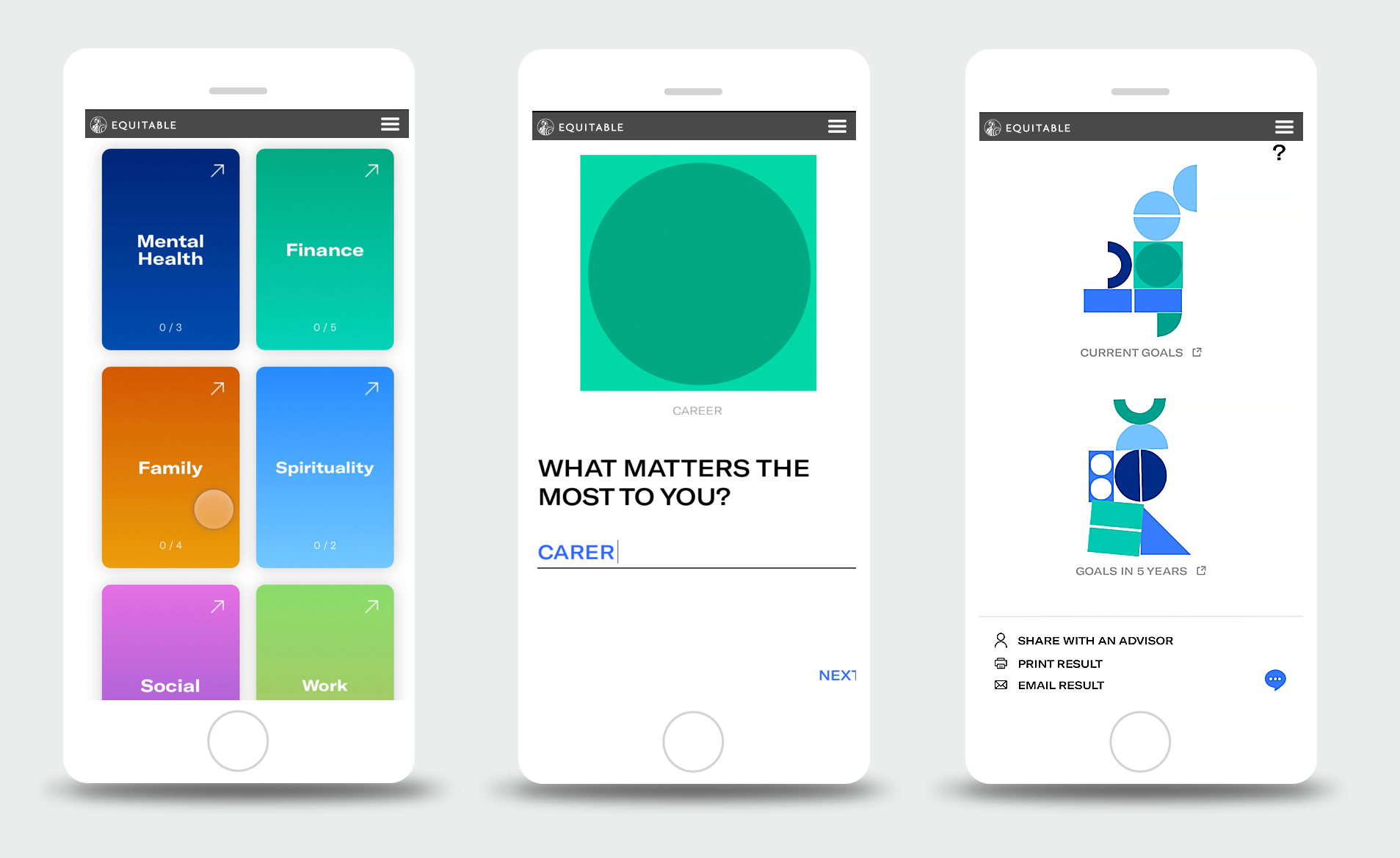

Two prototyped concepts were iteratively tested: One, a structured conversation through a questionnaire. Another, an open-ended conversation with an AI bot. Both concepts’ goals:

- Help customers holistically reflect on their current + future lives, where finances are an enabler vs a silo topic.

- Be a conversation starter for their family members and an Equitable financial advisor for a conversation that they might never have had prior.

- Provide data to customers on themselves + to Equitable on customers’ current + future needs.

- Educate customers through curated, reputable resources.

Enabling A New Kind Of Conversation On Finances

User testing led to developing the structured questionnaire prototype, an approach customers were more familiar with + trusted.

- All tested customers communicated that they didn’t have this type of conversation prior with a financial advisor or others.

- Language + interaction were inspired by methods used in Motivational Enhancement Therapy + the Nudge Theory.

The product provided:

- For customers: uncovered insights + contacted an Equitable advisor when they choose.

- For Equitable: informed data to develop advisors’ tools + training as well as transformation through human-centricity.